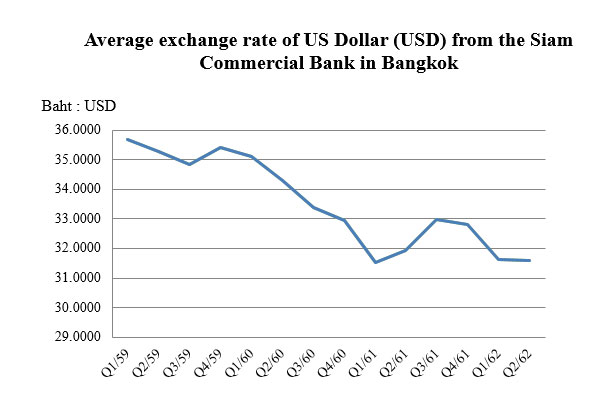

The Situation of Surging Baht

Source: Adjusted from an average exchange rate of the Siam Commercial Bank in Bangkok and the Bank of Thailand.

The drastic surge of Baht has direct impacts on the country’s economy especially export and tourism businesses, which are related to an acquisition of foreign currencies. In terms of export business, surging Baht affects capital costs leading to higher prices of Thai products. This also affects the competitiveness of Thai products in the world market.

Bank of Thailand or BOT, who is responsible for enforcing monetary policy to maintain Thailand’s financial stability, has been continuously monitoring the situation of surging Baht. On July 12, 2019, BOT has imposed short-term measures to counter hot-money inflows by issuing a Circular Letter No. BOT. For. Gor. Ngor. (21) Wor. 1035/2562 that regulates the limit of aggregated Thai Baht maintained in account of each non-resident (NR) more strictly to prevent from being a safe haven for short-term investment during surging period of Baht. The remaining balance in each Non-Resident Baht Account for Securities (NRBS) and Non-Residential Baht Account (NRBA) is reduced from 300 Million Baht to 200 Million Baht. Any financial institution must reduce the aggregated balance in holder’s account to be not exceeding 200 Million Baht by EOB of the effective date i.e. July 22, 2019, and must impose more strict measures to closely monitor investment by foreign investors from July 2019 onwards.

- Improve product quality and uniqueness to maintain consumer demand and reduce impacts from price competition;

- Use financial tools such as Forward Future Option to prevent any risks from exchange rate fluctuation. Being able to determine exchange rate in advance helps controlling cost and sale prices, as well as predicting fixed gains in the future;

- Own a foreign currency deposit (FCD) account to reduce any risks from exchange rate, especially for entrepreneurs who regularly use foreign currencies such as receiving payment in foreign currency and/or using foreign currency to purchase raw materials without having to convert money into Thai Baht and;

- Use local currency to trade instead of US Dollar.

BOT imposes these measures to prevent short-term hot money by reducing foreign inflows and to counter unnecessary surge of Thai Baht. Trade uncertainty and world economy situation, however, are also factors leading to the rise of Baht. Hence, the performance of this BOT’s policy must be monitored continuously.

Source : https://pixabay.com/photos/money-banknotes-currency-forex-1578510/

Source :

https://www.bot.or.th/Thai/AboutBOT/Activities/Pages/Currency_14022019.aspx

https://www.bot.or.th/Thai/FinancialMarkets/ForeignExchangeRegulations/Documents/QA_NRB.pdf

https://www.bot.or.th/App/BTWS_STAT/statistics/ReportPage.aspx?reportID=123&language=th

https://www.matichon.co.th/news-monitor/news_1578140

BACK

BACK